To be honest, the Fed is in an awkward situation when they make any monetary policy at this time around. Its dual mandates which are full employment and price stability catch the Fed in the middle.

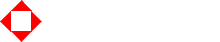

After two years' big efforts, the Fed has made some progress in terms of fighting record high inflation which ever peaked in August 2022 by rate cuts. Core PCE which is the Fed preferred inflation measure is back to 2.7% and seemingly is moving toward 2% inflation target. But abruptly, since President Trump's inauguration, the outlook for inflation is changing significantly given the tariffs policy which will likely cause stagflation scenario down the road, which will further make the Fed's job to fight inflation more tough.

Since last rate cut, the Fed has been adopting wait-and-see mode to watch the economic evolving development closely, just because series of policies in terms of trade, immigration, fiscal policy and regulation advocated by Trump administration are creating much more uncertainties which will matter a lot for the economic outlook and the path of monetary policy.

Economic projections the central bank released Wednesday indicate that while officials see inflation moving up this year more rapidly than previously expected. The outlook spurred talk again about “transitory” inflation that caused a major policy headache for the Fed.

The position is significant with markets concerned that President Trump’s tariffs could spark a broader global trade war that again would make inflation a problem for the U.S. economy. With markets nervous over proposals for tariffs and other issues, Powell reiterated statements the Fed has made recently counseling patience on monetary policy amid the high level of uncertainty. “The net effect of these policy changes will matter for the economy and for the path of monetary policy. We will be watching all of it very, very carefully. We do not take anything for granted.”

That is implying the Fed is forced into a corner, the mandates which not only need to protect the economy from tipping into a scenario of stagflation, but keep the price at a relatively stable level are pretty tough. The Fed should focus on separating the signal from the noise as the outlook evolves. Maybe it is smart for the Fed to wait for greater clarity before any policy move, in order to avoid making any policy mistakes.

Subscribe to Unlock this Article

Complete digital access to quality Glebors financial topic with expert analysis from industry leaders.

Glebors Financial Become an Glebors subscriber

Make informed decisions with the Glebors.Keep abreast of significant corporate, financial and political developments around the world. Stay informed and spot emerging risks and opportunities with independent global reporting, expert commentary and analysis you can trust.

- Financial reports are independent global financial research reports that you can trust. The information keeps pace with important companies around the world, global financial and political dynamics, independent insights and unique perspectives, helping you catch up with the latest information and identify the potential risks and opportunities.

- Our financial special reports use professional knowledge to fully understand the market situation, break down the perspectives of experts, and rationally analyze data to help you eliminate noise, accurately identify the changes in political, economic and social trends, and fully aware of the risks and grasp the opportunities.

- Our goal is to help shape the uniqueness of each research space we are involved in. Our research provides readers with new insights in terms of the global economy, financial markets, asset classes and risk management. We will continue to present new insights into global markets and industries.

"Insight of the global economy, dig into more ideas, analyze the global financial dynamics and the risks of political situation from a strategic, scientific and rational perspective, based on economic data and more than 20 years of financial intelligence."

Financial Reports

If you want to know more details to provide support for your investment and business activities, this financial report that we have selected for you can give you what you want, please subscribe to read it. Glebors Global Finance aims to provide business elites and decision makers with daily business news, data interpretation, in-depth analysis and commentary.

Glebors Global Finance’s amount of financial information digs into deeply major events and economic data that have a huge impact on the global economy, based on in-depth industrial research and special reports, with a truly global perspective。 Financial reports have become "must-read" financial information for senior managers. Gribs Global Finance currently has more than2.85 million Chinese readers and more than 3.5 million overseas readers, including more than 600,000 high-end member readers.